I still have the 'Certificate of Title' folder from the bank in which it was returned to us the first time, and a photocopy of the original Certificate of Title (but copies not certified.)

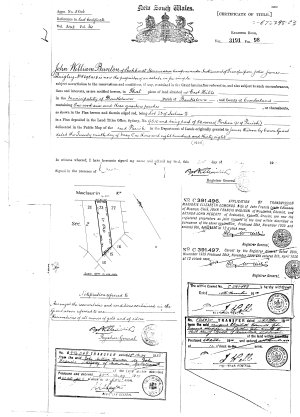

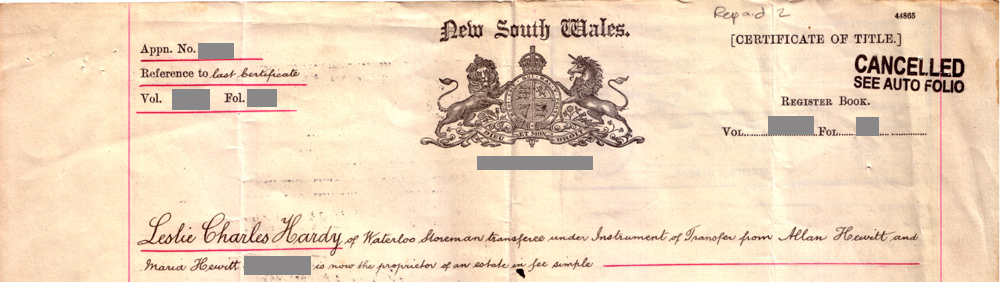

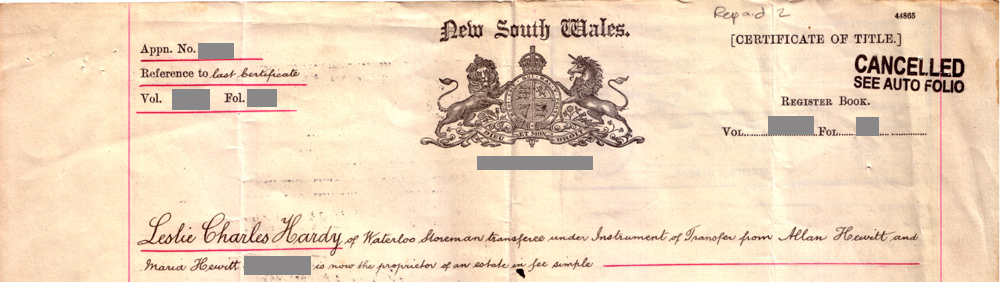

The original Certificate of Title is an impressive large (A3 size) document on long-lasting rag paper, recording ownership of the land and various mortgages since 1838.

Note the Certificate of Title states "proprietor of an estate in fee simple", which I understand to be the most powerful form of land ownership. It also defines within the document exactly what piece of land is owned, without relying on any external information sources. It stands on its own as a complete Deed.

I consider the Certificate of Title to be a valuable historic document in its own right, as well as being of very great personal value.

I consider the Certificate of Title to be a valuable historic document in its own right, as well as being of very great personal value.

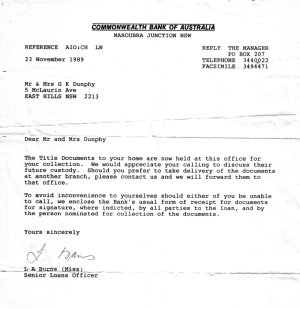

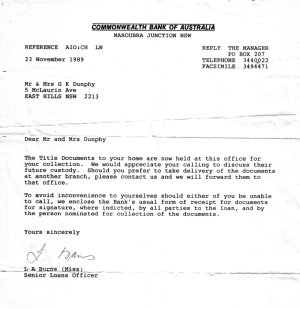

It's clear that in 1989 the bank also considered it an important document. At left is the letter the bank sent us after our first mortgage was repaid, saying our Title Documents were ready to be picked up, and offering to 'discuss their future custody'.

Then in 2007, the bank asserts the exact same Certificate of Title is so unimportant they can just (claim to) throw it away?

(Click for larger image.)

2nd Mortgage:

A loan to build a new large house on the land, taken in 1999. $170,000. — Paid off in Dec 2007.

In 1999 at loan contract signing the original Certificate of Title was handed to the bank's representatives.

I had fortunately made an A3 photocopy of the Certificate of Title (front & back) before handing the original to the bank.

While reading the CBA's loan contract beforehand I couldn't find explicit written guarantee that the original Certificate of Title would be returned on loan payout. Of course it should be, however I wondered why this wasn't stated anywhere. So at the mortgage signing meeting, I asked for assurance that it would be returned. I requested that the CBA's agent make a note on the contract to the effect that it would be returned on payout.

The CBA agent verbally assured me this was unnecessary, since of course it would be returned, as before.

I wasn't happy with this, but he was apparently refusing to make the note, and we did not have an option to decline the loan since we had already signed the construction contract with a builder. So proceeded without the written assurance.

We paid off the loan in Dec 2007. The bank never returned the original Certificate of Title document, despite repeated requests to them for it, and attempts to trace its whereabouts.

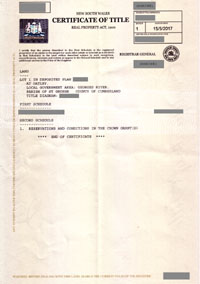

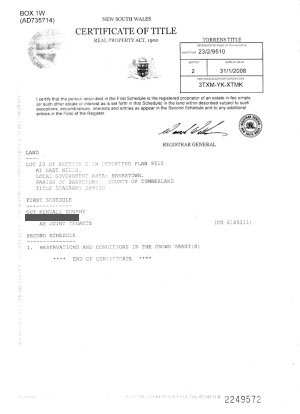

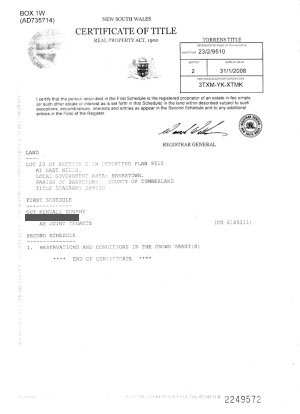

Instead we received (upon application and fee to the government) a plain A4 printout from the Lands Dept stating title to land, yet with no included specification of exactly what land, and containing no historical record whatsoever.

This miserable thing: (click for full size)

Note this document makes zero attempt to stand alone as a complete Deed. Not the slightest effort to define within itself exactly what land it refers to, with something like a diagram or map. It merely references by number a government database in which the land ownership details are held. If that database became unavailable, or was altered (accidentally or deliberately), this piece of paper would be utterly worthless.

Which means that it fundamentally is worthless as a guarantee of ownership of land. It is nothing but a note mentioning that the government agrees we own some land. Whereas the original Certificate of Title stood alone and was effectively as close to an allodial title as possible in today's world. Holding the Certificate itself was equivalent to holding the land.

Losing the original certificate was very upsetting. Owning one's own home and land is the height of achievement for an ordinary person, and that actual piece of rag paper held great significance for both of us. Particularly for me, given all the other disappointing things that were going wrong in my life and marriage. Now even the Commonwealth Bank was betraying me and stealing from me? Australia's most prestigious bank, who I had expected to be able to trust? They had stolen my actual Certificate of Title to my own land and home? It was shocking.

To make things worse, when on several occasions I made it clear that I would not accept this failure to to return a document of great personal and historic value to me, and verbally demanded the original Certificate of Title document be returned, or at least some news of what happened to it, the bank variously claimed:

- It is probably in some huge CBA document warehouse.

- Is superceeded by new proceedures at Lands Titles Office, the small A4 doc is all that's needed.

- Can't be found (by branch office.)

- Was probably routinely disposed of by Land Titles Office, due to it being 'old style'. I then went to the LTO and obtained a copy of their internal proceedures, which states all documents are to be returned to bank officers. That includes 'superceeded' old-style titles.

- On presentation to the bank of 'internal proceedures' doc from LTO stating Title docs to be returned to bank, bank then claimed "Bank probably discarded it when returned from LTO after registering mortgage."

Only the first of those excuses is even faintly believable. Consider that in 1989 the CBA returned the Certificate of Title in a well-produced custom folder, printed with a caution that the contained Certificate of Title should be kept in a secure place. Which is true, and implies that the document itself is important. Are we supposed to believe that just 18 years later, in 2007, a Certificate of Title is so unimportant that the bank would just bin it as rubbish?

Their lies are the rubbish. Non-return of that document is theft.

So much irony in the wording of that CBA folder!

"Your CERTIFICATE OF TITLE is enclosed in this folder. We suggest that you keep it in a secure place."

Whereas, when we next get our hands on it, you can forget about ever seeing it again.

There's more to this

To understand what is likely really going on here, one has to understand two things. One is the way in which land Titles, Mortgages and the government system of land ownership registration are supposed to work.

And secondly a modern financial 'innovation' known as a CDO, or Collateralized Debt Obligation, and how these broke the land ownership registration system. There has been a huge scandal in the last few years in the USA involving CDOs and a related monstrosity known as MERS. The scandal and the financial disasters caused by CDOs and MERS are still ongoing.

In the USA these things came to light due to there being some honest investigators and news organisations still. In Australia it's different, and we don't seem to know with certainty if the CBA and other banks did such things.

Another potential connection is that the CBA refused to return the Title Certificate in December 2007. This was during the early years of State and Local Government planning for the forced mass theft of properties across Sydney, via extreme rezonings, on the pretext of 'necessity for housing projected higher population.'

See Review of Bankstown Council rezoning plan.

How convenient for local councils, if as many affected residents as possible no longer have their original "proprietor of an estate in fee simple" Certificates of Title! I'm told these old papers are 'now obsolete.' But I don't believe it. I'd be more inclined to suspect they are actually the strongest possible legal form of land ownership, and thus represent something of an obstacle to government ambitions of mass property theft.

References

%%% This section incomplete. I have a lot of reference material, but need to organise and add.

Here are a few Web references on this practice, which is nothing short of outrageous fraud on a massive scale.

- CDOs (Collateralized Debt Obligations)

For anyone who finds it hard to believe Banks could engage in such behaviour, or (shock) actually lie and deceive about what they are doing, here's a few more articles on the Banks.

My suspicion is that the CBA had in fact taken up the American practice of issuing CDOs (Collateralized Debt Obligations), in which a number of mortgages and the associated title deeds are 'bundled' and represented by a tradable certificate, which the bank sells on the markets. The underlying documents then enter a limbo in which their ownership is clouded. In a practical sense they are sent to some kind of bonded warehouse for the duration of the mortgage face duration. This makes them unavailable to the bank, in the unexpected situation where a borrower pays off the loan in full, far earlier than the face duration.

It would be interesting to pursue the question of whether the CBA really did bundle mortgages as CDOs, whether that does in fact qualify as conversion of the property ownership, and thus contract fraud on the homeowner, and whether by such acts the corporation that calls itself the Commonwealth Bank of Australia was acting ultra vires.

Do you still posess an old, historic land Certificate of Title?

Then be warned. It's apparently now official policy to destroy or steal these at every opportunity.

You can draw your own conclusions as to why that may be.

My opinion — if I needed a mortgage from a bank, I'd 'lose' my original Certificate of Title first, and give the bank a crappy govt-printed substitute instead. I'll never again hand over an original title deed to the bastards.

And why shouldn't you keep the original Certificate of Title if you want to? According to the bank, and the laywer I consulted about this, "those things are obsolete." The lawyer even said that landowners don't own the actual Certificate of Title piece of paper; that's owned by the government. Ha ha ha! Imagine if all contracts were like that - the other party owns the physical paper your contract is printed on, and can take it away and destroy it any time they like. Especially when the 'other party' is the government. Did someone say 'Rule of Law'? Ha ha, not any more. That's obviously obsolete too.

Anyway, if the physical Certificate of Title is so damned irrelevant and useless now, why would the bank even need it when granting you a mortgage? Tell them you don't feel like handing it to them, and they can just deal with the Department of Lands directly to register their lien on the property.

No really, try it. See how that goes.

Why do I suspect the bank will still insist on being entrusted with the original Certificate of Title?

If you've come to the point where they know you have the original Certificate of Title, and insist you hand it over, then make them show you where in the loan contract they guarantee to return that specific physical original Certificate of Title to you once the mortgage is paid off. Insist on writing in a massive penalty clause for failure to perform on that specific item. If they can't or won't, then what I should have done back then with the CBA, was tell them to go f*ck themselves and their fiat numbers no-cost-to-them mortgage too.

If you're unlucky enough to absolutely not have that as an option, at least make some high quality full size copies of the Certificate of Title, and get them legally certified as copies, before handing it over. You probably won't ever see it again.

Anyway, the best option is to avoid direct confrontation with these bastards, these robbers under colour of law, and just lie. Say the original Certificate of Title has somehow been mislaid. But they are welcome to get a worthless ink-jet printed substitute if they want it. My guess is they wouldn't even bother to pay the fee to have it printed up.

If the government and banks feel they can unilaterally twist and pervert such basic foundations of civilization as Contracts and Property Titles to suit their thieving ends, you no longer have any obligation of truthfulness to them.

Did an Australian bank steal your Certificate of Title too?

I'd like to hear from others in Australia with similar experiences. Handed over an original Certificate of Title, later paid off the mortgage, then found the bank would not return the original Certificate of Title. I've heard several rumors of this happening over recent years. But how common is it really? Does anyone ever get their Certificate of Title back any more?

If this is happening to lots of people in Australia but we are hearing nothing of it in the media, that leads into a huge potential tangle of mainstream media and government conspiracy. Which despite the derision the MSM pours on such concepts, is far from unrealistic.

Contacts

Email: land_cert_theft@everist.org

Mail: Guy Dunphy, 5 Maclaurin Av East Hills 2213, Sydney NSW, Australia.

Please clearly mark correspondence at top as Private or Public.

Correspondence marked Public, or unspecified, may by published on this site.

Since I first posted this article, several people have contacted me with similar tales of their original Title Deed being 'vanished' by banks. But they didn't want their details published. Anyway, it's definitely not a fluke occurence.

Also another part of the puzzle has turned up - official 'cancelling' of old Title Deeds.

Into the Void of Cancelled

In 2017 my aged mother decided to update her Will. My father (mum's husband) had died in 1996. At some point in the 1990s or early 2000s their original home loan had been fully paid off. They'd received the original Title Deed back from the bank, and it was safe in mum's keeping. Now in 2017 during the process of her speaking with her solicitor to update the Will, he asked her if she had ever had the Title Deed updated to reflect my dad having died, making her the sole owner of the property. She said no, she hadn't. She did have dad's death certificate.

The solicitor jumped on this, and insisted the Title Deed should be sent off to the Dept of Lands, with a copy of the death certificate, to have the title updated. I was there, and he didn't mention any other consequences. So she handed him the original Title Deed, for him to organise it. Big mistake.

It was a large format document, much like mine had been. With a history of tranfers and a map on it.

About a week later, it occured to me to ask the solicitor "Just checking, but we do get the Title Deed back, right?"

Paraphrased conversation:

"Oh no, those old ones are obsolete. They destroy them and send you a new title document."

"WHAT!? You didn't tell us that! That's not acceptable! Did you send it off yet?"

"Yes, sent it a few days ago."

"Arrgh! Then contact them and tell them to stop. We want it back!"

"What's the problem? Those old ones are no longer valid. They issue you a new one. There's an option to not destroy the old one, if you really want it for sentimental or historical interest. It will just be marked 'CANCELLED'."

"Good grief. OK, if that's the best you can do."

The rest of the conversation, in which I made it clear I thought it was negligent of him to omit telling us this in the first place, and him not seeing anything at all wrong with the old deeds being destroyed, is not worth repeating.

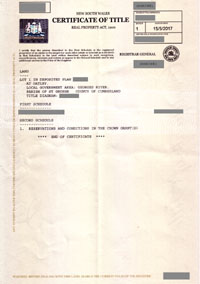

We did get the original deed back, marked "CANCELLED SEE AUTO FOLIO" with a stamp.

|

|

|

| The new Title Deed | | Letter from solicitor |

Now here's the interesting bit. Their logic doesn't hold up.

The official claim is, all these old Title Deeds are by nature obsolete. And yet we had to send it in together with the death certificate, to update the government land registry system. You see the problem? If it's no longer valid, and their database is the sole authority, then they should have only needed the death certificate. And why bother to stamp the actual deed "CANCELLED", if it already is invalid?

My position is, the old Title Deeds are still valid. How could they just be universally declared obsolete, by government fiat? If that was legally feasible it would make a mockery of the entire concept of private ownership of land, and the original certificates which were the original contracts between land purchasers from the Crown, and superior proof of that ownership.

So up until we handed over the document, it plus the death certificate formed an absolute legal proof of my mum's sole title to the property. It was still valid.

I also think the "CANCELLED" stamp cannot be legally valid. It doesn't have any signature or proof of authority (not that there could be any.)

But apparently, in any dealings with the government in which the old format Title Deeds come into the government's hands, they will physically destroy them if they can get away with it. Or send them back stamped "CANCELLED" if the land owner insists on the document's return. (Few will.)

Setting up for Deliberate Disaster

This kind of incredible behavior would tend to make one suspect there's some kind of underhanded government intent to destroy the integrity of the system documenting Chain of Title to land. In which case the Banks 'losing' Title Deeds and getting away with it can be seen as complicity in this intent.

And then... the government takes another step that demonstrate these suspicions are valid.

It comes up in the news that the government is planning to sell off the entire function of maintaining Chain of Title, and gathering the revenue from stamp duty on land sales, to a private company. And it looks like the prime contender is some shell company registered in an overseas tax haven.

Oh excellent. Destroy or cancel all the original long-lasting rag paper title deed documents, that include maps and history detailing exactly what, where and who owns what. Replace them with a government computer database as the sole and legally superior authority on who owns what. And then sell the ongoing operation and supervision of that database off to a shonky overseas-based company. Bearing in mind that land transfer stamp duty is a major, highly profitable source of income for the government. So why would they sell this off, unless they had some motive other than legitimate profit?

You can't make this shit up.

This is something I haven't had time to look into well yet.

All this forces one to the conclusion — there is something stinky afoot with the system that's supposed to maintain reliable Chain of Title to land. The original Title Deeds are being destroyed by both the Government and Banks, and any surviving are claimed to be 'obsolete' and must be cancelled.

They wouldn't be doing this if the original Title Deeds presented no legal obstacle to their scheme.

So... under no circumstances ever give over your original large format Title Deed to the hands of lawyers, banks, government, or whatever entity ends up running the privatized lands register. Keep it hidden, deny you have it if asked. Let them play with their new database and crappy A4 laserprinted substitutes (that have no map.)

Someday this scam they're building up to, will blow up. After which the old Title Deeds will be crucial proofs of ownership once more.

Others having the same experience

Lest you think this is just me having bad luck, in the interval this page has been online, so far five others have contacted me about having had the same experience — bank demanded their Certificate of Title as collateral for a mortgage, then refused/failed to return it on repayment of the loan. With the same kind of evasive run-around about those certificates now being 'thrown out, destroyed as obsolete, government told them to, etc.'

Considering that this rough-edged little site of mine is far from widely seen, that's a surprising number. I wouldn't be at all surprised if these days no one ever gets their original old-format title deed returned.

To include:

* research Australian "residential mortgage backed securities (RMBS)"

These seem to be the local equivalent of US CDOs.

Ah ha! google rmbs cba - lots!

https://www.commbank.com.au/about-us/Securitisation/overview-of-securitisation.html

Overview of securitisation (with timeline. Issues since 1997 )

https://www.commbank.com.au/about-us/Securitisation/mortgage-backed-securities.html

Mortgage backed securities are debt obligations that represent claims on the cash flows

from mortgage loans, commonly on residential properties.

Below you’ll find the reports for the Bank’s mortgage backed securities.

Redeemed Trusts - Medallion, CATS, GoldStar and Swan

Series 1997-1 Medallion Trust

Series 1998-1 Medallion Trust

Series 2000-1G Medallion Trust

https://www.commbank.com.au/about-us/Securitisation/mortgage-backed-securities/series-2000-1g-medallion-trust.html

Issue Date: 27th March 2000

Maturity Date: 12th July 2031

Series 2000-2G Medallion Trust

https://www.commbank.com.au/about-us/Securitisation/mortgage-backed-securities/series-2000-2g-medallion-trust.html

Issue Date: 14th September 2000

Maturity Date: 18th December 2031

Series 2001-1G Medallion Trust

Series 2002-1G Medallion Trust

Series 2003-1G Medallion Trust

Series 2004-1G Medallion Trust

Series 2005-1G Medallion Trust

Series 2005-2G Medallion Trust

Series 1997-1 Cats Trust

Series 1998-1 Cats Trust

Series 1999-1E Cats Trust

Series 1999-1 Goldstar No. 1

Series 2002-1E Swan Trust

Series 2006-1E Swan Trust

---------------

Ah ha! Bingo. The magic google keywords are 'CBA RMBS'

Thank you.

Apparently in Australia they are called 'Residential Mortgage Backed Securities' not CDOs,

and yes the Commonwealth Bank has been doing them since 1997.

"Mortgage backed securities are debt obligations that represent claims on the cash flows

from mortgage loans, commonly on residential properties."

https://www.commbank.com.au/about-us/Securitisation/overview-of-securitisation.html

https://www.commbank.com.au/about-us/Securitisation/mortgage-backed-securities.html

https://www.commbank.com.au/about-us/Securitisation/mortgage-backed-securities/series-2000-1g-medallion-trust.html

Super boring stuff, unless your own land title certificate is locked up in one of CBA's

document warehouses as a result.

Specifically as a result of that last link, I strongly suspect.

Fuck you, CBA.

----------------------------

Also of general relevance

https://twitter.com/DavidSchawel/status/583995848444510208/photo/1

David Schawel, 20150405

Fun fact: If you have a 30yr 4.5% mortgage, your loan is being traded at

107 cents on the dollar in the TBA market.